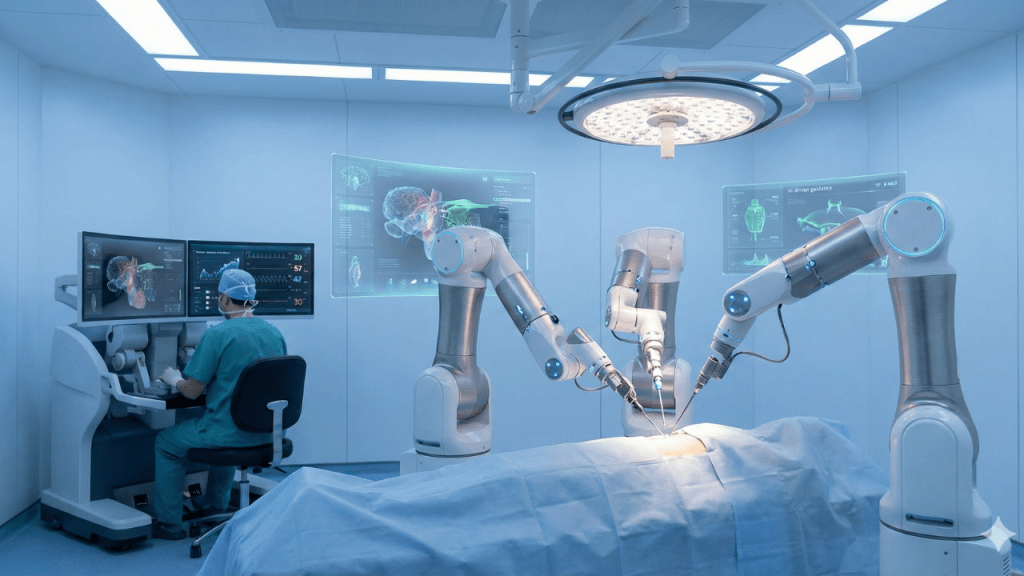

The healthcare industry stands at the precipice of a technological revolution. As artificial intelligence continues to advance rapidly across multiple sectors, one area remains particularly compelling for forward-thinking investors: surgical robotics powered by AI technology. While fully autonomous AI surgery hasn’t arrived yet, the foundations are being laid today, and two companies are positioning themselves at the forefront of this transformation.

The concept isn’t far-fetched. If we trust computer programs to navigate vehicles through complex traffic patterns, it’s reasonable to envision them assisting—and eventually performing—intricate surgical procedures. The technology is already in motion, with AI systems currently supporting human surgeons during operations. For investors willing to look beyond the immediate horizon, this presents an opportunity to invest before the technology reaches mainstream adoption.

The Case for Surgical Robotics Investment

Despite ongoing discussions about potential bubbles in the AI sector, investor enthusiasm remains robust, and for good reason. The trajectory is clear: sophisticated computer systems are progressively integrating into virtually every aspect of modern life. Healthcare, particularly surgical medicine, represents one of the most promising applications of AI technology that has yet to reach full maturity.

The appeal of surgical robotics extends beyond theoretical possibilities. These systems offer tangible benefits including enhanced precision, reduced invasiveness, faster patient recovery times, and the potential to extend specialist surgical capabilities to underserved regions. As the technology matures, the market opportunity expands proportionally.

Two companies have established themselves as leaders in this emerging field, each offering distinct investment profiles suitable for different portfolio strategies.

Intuitive Surgical: The Pure-Play Pioneer (NASDAQ: ISRG)

Company Overview and Market Position

For investors seeking concentrated exposure to surgical robotics, Intuitive Surgical represents the archetypal pure-play opportunity. The company has dedicated its entire business model to developing and deploying surgical robotic systems, making it a pioneer in the space with decades of experience and market leadership.

Trading on NASDAQ under the ticker ISRG, Intuitive Surgical commands a market capitalization of approximately $180 billion. The stock closed at $504.22, reflecting investor confidence in the company’s growth trajectory despite near-term volatility.

Growth Metrics and Operational Performance

The numbers tell a compelling growth story. Throughout 2025, Intuitive Surgical installed 1,721 da Vinci surgical robots, representing an impressive 13% increase compared to 1,526 installations in 2024. More significantly, the total installed base reached 11,106 systems by year-end 2025, marking a 12% year-over-year expansion.

Installation figures only capture part of the picture. The real indicator of market acceptance comes from utilization rates. The number of procedures performed using da Vinci systems surged 18% year-over-year in 2025, demonstrating robust demand from both medical facilities and patients. Management projects continued momentum, forecasting procedure growth of up to 15% for 2026.

These growth rates become even more impressive when considering the company’s already substantial market position. Sustaining double-digit growth at this scale suggests genuine market expansion rather than mere market share gains.

The AI Integration Story

The investment thesis extends well beyond current robotics capabilities. The FDA recently approved an AI tool designed to assist surgeons in making real-time adjustments during lung surgery procedures. This approval marks a watershed moment—artificial intelligence is no longer theoretical in surgical applications; it’s actively participating in procedures.

The implications extend far beyond this single application. Every da Vinci robot generates vast quantities of operational data during procedures. This data represents a treasure trove for training advanced AI systems. The company is already collecting information from thousands of surgical robots performing hundreds of thousands of procedures annually.

Consider the progression: current systems assist human surgeons with enhanced precision and control. The newly approved AI tools add real-time decision support. The logical next step involves increasingly autonomous AI systems capable of handling routine aspects of procedures, eventually progressing toward fully autonomous surgical capabilities for specific operation types.

Intuitive Surgical’s installed base provides a significant competitive advantage in this evolution. The data network effect grows stronger with each additional robot and procedure, creating barriers to entry for potential competitors.

Valuation Considerations

Premium growth comes with premium valuations. Intuitive Surgical trades at a price-to-earnings ratio of 67, placing it firmly in growth stock territory. The company’s gross margin of 70.56% demonstrates pricing power and operational efficiency, but the elevated valuation multiple demands continued strong execution.

This valuation level suits aggressive growth investors comfortable with volatility and extended time horizons. The bet centers on the company maintaining its technological leadership and market position as surgical robotics expand globally and AI capabilities mature. For investors who believe autonomous surgery represents an inevitable evolution rather than a distant possibility, current prices may offer an entry point before the technology transition fully materializes.

However, investors must acknowledge the inherent risks. Technology transitions rarely follow smooth, predictable paths. Regulatory hurdles, competitive threats, technological limitations, or market acceptance challenges could impede the optimistic scenario reflected in current valuations.

Medtronic: The Diversified Alternative (NYSE: MDT)

Company Profile and Business Mix

Investors seeking exposure to surgical robotics within a more diversified framework should examine Medtronic. Trading on the NYSE under ticker MDT, this medical device giant operates across multiple healthcare segments including cardiovascular, neuroscience, diabetes, and surgical robotics.

With a market capitalization of approximately $129 billion, Medtronic represents one of the world’s largest medical device companies. The stock price of $102.96 reflects a more moderate valuation profile compared to pure-play alternatives, offering a different risk-reward proposition.

Diversification as Risk Management

Medtronic’s business diversification provides inherent stability advantages. While Intuitive Surgical’s fortunes tie entirely to surgical robotics success, Medtronic generates revenue across multiple proven medical device categories. This diversification moderates company-specific risks associated with any single technology or market segment.

The company’s gross margin of 59.95% reflects this broader business mix. While lower than Intuitive Surgical’s specialized margins, it demonstrates solid profitability across diverse product lines. The price-to-earnings ratio of 27, though elevated in absolute terms, appears considerably more moderate than Intuitive Surgical’s 67 multiple.

Surgical Robotics Opportunity

Medtronic’s Hugo surgical robotic system operates in the same competitive space as Intuitive Surgical’s da Vinci platform. While the company trails in market penetration and installed base, the same AI opportunities that apply to da Vinci systems extend to Hugo platforms.

The surgical data generated by Hugo systems can similarly train AI algorithms. The technological pathway toward increasingly autonomous surgical procedures applies regardless of which robotic platform achieves market dominance. Medtronic’s established relationships with healthcare systems worldwide provide distribution advantages as the company expands its robotic surgery footprint.

The company’s later entry to the surgical robotics market means it hasn’t yet matched Intuitive Surgical’s installation pace or procedure volumes. However, this also suggests significant growth potential as Medtronic leverages its existing customer relationships and resources to expand market share.

Income Generation Component

Medtronic offers a dimension entirely absent from Intuitive Surgical’s investment case: dividend income. The company provides a 2.80% dividend yield, substantially exceeding the S&P 500 index’s current 1.1% yield. More impressively, Medtronic has increased its dividend for 48 consecutive years, qualifying it as a Dividend Aristocrat.

This dividend history demonstrates management’s commitment to shareholder returns and provides evidence of consistent cash flow generation across business cycles. For investors who value current income alongside growth potential, or those who prefer the behavioral discipline that dividends impose on management teams, this represents a meaningful differentiator.

The combination of surgical robotics growth potential, business diversification, and reliable dividend income creates an investment profile suitable for more conservative growth investors or those building balanced portfolios.

Strategic Catalyst: Diabetes Division Spin-off

Medtronic has announced plans to spin off its diabetes division as a separate company. Management positions this strategic move as a catalyst to improve the remaining company’s profitability and growth profile by allowing focused execution in core medical device segments.

Spin-offs frequently unlock shareholder value by allowing specialized management teams to optimize operations without compromise. The diabetes division, while valuable, operates in a different competitive landscape with distinct dynamics from medical devices. Separating the businesses may allow each to pursue optimal strategies independently.

This corporate action introduces both opportunity and uncertainty. Investors considering Medtronic should evaluate whether they want exposure to the combined entity or prefer to wait until post-spin-off operations stabilize. However, investors seeking to establish positions before this potential catalyst materializes may find current timing advantageous.

Comparing Investment Profiles

Growth vs. Stability Trade-off

The choice between these two companies ultimately reflects individual investor priorities and risk tolerance. Intuitive Surgical offers pure-play exposure to surgical robotics with higher growth rates, commanding market leadership, and concentrated focus. This specialization delivers acceleration when the thesis plays out correctly but concentrates risk if market conditions or competitive dynamics shift adversely.

Medtronic provides diversified exposure with more moderate valuations, established dividend income, and reduced dependence on any single technology or market segment. Growth rates may lag pure-play alternatives, but business diversification moderates downside risks.

Valuation Considerations

Valuation perspectives differ significantly between the companies. Intuitive Surgical’s P/E ratio of 67 reflects market expectations for sustained rapid growth and eventual market dominance in AI-powered surgery. Investors purchasing at this level bet on the company maintaining technological leadership through the industry’s evolution.

Medtronic’s P/E ratio of 27, while still elevated, provides more valuation cushion. The lower multiple means less aggressive growth assumptions are priced into current levels, potentially reducing downside risk if surgical robotics adoption proceeds more slowly than optimists envision.

Time Horizon Considerations

Both investments require patience. Fully autonomous AI surgery remains years away from mainstream implementation. Regulatory approval processes, technological refinement, surgeon training, patient acceptance, and reimbursement frameworks all require time to develop.

Intuitive Surgical may offer greater upside if AI surgery adoption accelerates rapidly. The company’s market leadership and data advantages position it to capture disproportionate value in a winner-take-most scenario.

Medtronic provides steadier performance during the development phase through its diversified revenue streams and dividend payments. The company offers a way to participate in the surgical robotics opportunity while collecting income and maintaining exposure to proven medical device markets.

Market Opportunity Assessment

Demographic and Healthcare Trends

Several macro trends support the surgical robotics investment thesis. Aging populations in developed markets increase demand for surgical procedures. Healthcare cost pressures encourage adoption of technologies that improve efficiency and reduce complication rates. Surgeon shortages in many regions create demand for technologies that extend existing surgeon capabilities.

Minimally invasive procedures enabled by robotic systems typically result in shorter hospital stays, reduced complications, and faster recovery times. These benefits align with healthcare system objectives to improve outcomes while managing costs. As clinical evidence accumulates demonstrating these advantages, adoption rates should accelerate.

Geographic Expansion Potential

Current surgical robot penetration remains concentrated in developed markets, particularly the United States. International markets, including Europe, Asia, and Latin America, represent substantial growth opportunities as healthcare infrastructure develops and capital becomes available for technology investment.

Both companies have established international distribution capabilities. As global healthcare spending increases and medical technology adoption expands in emerging markets, surgical robotics should benefit from geographic diversification of demand.

Procedure Type Expansion

Current robotic surgery applications concentrate in specific procedure types where the technology demonstrates clear advantages. As systems improve and surgeon experience accumulates, the range of applicable procedures should expand progressively.

Each new procedure type that proves suitable for robotic assistance expands the addressable market. The companies that establish early leadership in new procedure categories can build data advantages and market positions that competitors struggle to overcome.

Risk Factors to Consider

Technological and Competitive Risks

Surgical robotics remains a dynamic field with ongoing technological development. Breakthrough innovations from competitors could disrupt current market leaders. Large medical device companies or well-funded startups might introduce superior systems that erode existing market positions.

The path to autonomous AI surgery involves solving complex technical challenges. Computer vision, real-time decision-making, handling unexpected complications, and ensuring patient safety all require sophisticated solutions. Progress may prove slower or more difficult than optimistic scenarios assume.

Regulatory Complexity

Medical devices face rigorous regulatory oversight, appropriately so given patient safety implications. Increasingly autonomous AI systems will likely face even more stringent approval requirements. Regulatory processes could slow adoption or impose requirements that limit commercial viability.

Different global markets maintain distinct regulatory frameworks. Successfully navigating multiple regulatory jurisdictions while maintaining technological competitiveness requires substantial resources and expertise.

Reimbursement Challenges

Healthcare provider adoption depends significantly on reimbursement frameworks. If insurance companies and government healthcare programs don’t provide adequate reimbursement for robotic procedures, adoption rates will suffer regardless of clinical benefits.

Establishing reimbursement typically requires extensive clinical data demonstrating improved outcomes or reduced total treatment costs. Building this evidence base takes time and resources.

Market Acceptance

Both surgeon acceptance and patient acceptance matter. Surgeons must learn new techniques and potentially cede some control to AI systems. Patients must trust machines to perform delicate procedures on their bodies. Cultural factors, liability concerns, and natural conservatism in medical practice could slow adoption beyond what technological capabilities alone would suggest.

Investment Strategy Recommendations

For Aggressive Growth Investors

Investors comfortable with volatility and extended time horizons may find Intuitive Surgical appealing. The pure-play exposure offers maximum leverage to surgical robotics growth. The company’s market leadership and data advantages position it well for the AI evolution.

Position sizing remains crucial given the elevated valuation. Even confident investors should consider limiting exposure to levels they can comfortably maintain through inevitable volatility. The investment thesis may ultimately prove correct while the stock experiences significant drawdowns during the journey.

For Balanced Growth Investors

Medtronic suits investors seeking surgical robotics exposure within a more conservative framework. The diversified business model and dividend income provide stability while maintaining participation in the growth opportunity.

The upcoming diabetes spin-off creates both opportunity and complexity. Investors should research the transaction details and consider whether they want exposure to the combined entity or prefer to wait for post-spin clarity.

For Income-Focused Investors

Dividend-oriented investors face a clear choice: Intuitive Surgical offers no current income, while Medtronic provides a 2.80% yield with a 48-year growth history. For investors who value current income or prefer the discipline that dividend commitments impose on management, Medtronic represents the only option between these two companies.

Portfolio Diversification Approach

Some investors may choose to hold both stocks, capturing pure-play upside through Intuitive Surgical while maintaining diversified exposure and income through Medtronic. This approach provides participation in multiple scenarios: if surgical robotics grows explosively, Intuitive Surgical should outperform; if growth proves more moderate or faces setbacks, Medtronic’s diversification and income provide downside protection.

Looking Forward

The surgical robotics investment thesis rests on a fundamental belief: AI will eventually perform surgery. Whether this occurs in five years, ten years, or longer remains uncertain. The specific technological pathway and market structure that emerges remain equally unclear.

What seems reasonably certain is that Intuitive Surgical and Medtronic will participate meaningfully in whatever future emerges. Both companies possess the resources, expertise, installed bases, and strategic focus to remain relevant as the technology evolves.

The investment decision ultimately depends on individual circumstances, risk tolerance, time horizon, and conviction level. Aggressive growth investors might concentrate positions in Intuitive Surgical, betting on maximum exposure to the pure-play story. Conservative investors might prefer Medtronic’s diversification and income. Others might blend both positions for balanced exposure.

Regardless of which approach resonates, investors should maintain realistic expectations about timeframes and volatility. Transformative technologies rarely deliver smooth, linear returns. Patient investors who believe in the long-term thesis while managing position sizes appropriately stand the best chance of successfully navigating the journey.

Conclusion

Artificial intelligence in surgery represents more than speculative future technology—the transformation has already begun. AI tools are assisting surgeons today. Robotic systems are performing hundreds of thousands of procedures annually. The data foundation for training more sophisticated AI systems is being built with every operation.

Intuitive Surgical and Medtronic offer investors two distinct paths to participate in this evolution. Intuitive Surgical provides concentrated exposure with higher growth potential and corresponding risks. Medtronic offers diversified participation with more moderate valuations, established dividend income, and reduced dependence on any single technology.

The question isn’t whether AI will eventually perform surgery—the trajectory points clearly in that direction. The questions are when, how quickly, and which companies will dominate the resulting market. Investors willing to commit capital before these questions resolve completely may find themselves positioned advantageously when clarity eventually emerges.

As with any investment in emerging technologies, discipline matters as much as conviction. Position sizing, diversification, and realistic time horizons separate successful long-term technology investors from those who struggle with volatility. The surgical robotics opportunity appears genuine and substantial, but realizing returns requires patience, careful analysis, and appropriate risk management.

For investors conducting their own research and reaching their own informed conclusions, both Intuitive Surgical and Medtronic merit serious consideration as potential vehicles for participating in the AI-powered surgery revolution. The choice between them—or the decision to own both—depends on individual investment objectives, risk tolerance, and portfolio construction philosophy.

Want to actually take action instead of just reading?

Most people understand what they should do with money — the problem is execution. That’s why I created The $1,000 Money Recovery Checklist.

It’s a simple, step-by-step checklist that shows you:

and how to start building your first $1,000 emergency fund without overwhelm.

- where your money is leaking,

- what to cut or renegotiate first,

- how to protect your savings,

- and how to start building your first $1,000 emergency fund without overwhelm.

No theory. No motivation talk. Just clear actions you can apply today.

If you want a practical next step after this article, click the button below and get instant access.

>Get The $1,000 Money Recovery Checklist<

Note: Stock data referenced includes closing price of $504.22 for Intuitive Surgical (NASDAQ: ISRG) and $102.96 for Medtronic (NYSE: MDT), market capitalizations of approximately $180 billion and $129 billion respectively, P/E ratios of 67 and 27, and Medtronic’s dividend yield of 2.80%. All figures represent market conditions as of the referenced date and are subject to change. Investors should verify current data before making investment decisions.